The largest stages in the world do not merely increase the volume; they increase the volume of sound, ideas, trends, and, increasingly, the signals of investment. Over the last several years, a new story has moved from backstage directly to the forefront: musicians taking the big bitcoin risk. It is no longer a case of a single tweet or a showy sponsorship; it is all about faith, financial literacy, and the type of branding that goes way beyond album releases. If a musician who is among the best-selling artists shows interest in digital money with a hard cap, fans will not only take notice, but also venture capitalists, exchanges, and mainstream media. This feedback loop has made it easier for crypto—especially Bitcoin—to be seen as a cultural movement with longevity instead of just a niche forum topic.

But what makes this trend occur at this specific time? The reasons are intertwined with the factors of tech maturity, fan engagement, and new revenue rails. Musicians are the ones who adopt these platforms earliest as they feel the need for control, transparency, and a bigger share of the value. They have been the scouting ones watching the alteration of streaming with respect to payouts; they have felt the industry getting their touring upside-down! So when a network of payments that is open to all and with definite scarcity claims worldwide presence, they get ready to hear what is being said. Now, adding the growing acceptance surrounding wallets for artists, on-chain royalties, tokenization of communities, and even cross-ecosystem transfers via cross-chain crypto bridge, you have a generation of creators who see Bitcoin not as a passing trend but as an indispensable part of their diversified, future-proofed portfolio.

Jay-Z: Blueprinting Wealth Beyond the Billboard

Few moguls understand legacy like the artist behind Empire State of Mind. His career arcs from Marcy Projects hustle to boardroom vision, and that lens shapes how he approaches technology and finance. Known for surgical moves—artist ownership, catalog strategy, streaming equity—he thinks in decades, not cycles. That mindset dovetails with the way many long-term holders frame Bitcoin: as monetary infrastructure with a supply schedule you can’t fast-talk or compromise. When he makes a strategic bet, it’s usually about access, education, and setting the stage for the next generation to thrive.

The paper trail is unusually clear: in February 2021, he teamed with Jack Dorsey to endow ₿trust with 500 BTC, a blind fund mandated to support Bitcoin development in Africa and India—an early, unambiguous signal that his interest skewed long-term and infrastructure-level rather than hype cycles. A year later, they launched The Bitcoin Academy as a free, 12-week program at Marcy Houses—complete with smartphones, MiFi, a year of data, and a small crypto stipend—to teach residents custody basics and financial literacy rooted in Bitcoin’s model. He leaned into on-chain culture—switching his avatar to CryptoPunk #6095 and commissioning a Sotheby’s NFT tied to Reasonable Doubt’s 25th anniversary—while also aligning his music business with payment rails when Block (then Square) bought a majority stake in Tidal for roughly $297 million in cash and stock, adding him to the fintech firm’s board. Together, those moves map a thesis: education and open-protocol ownership, anchored by Bitcoin, plus distribution rails that can move value as easily as music.

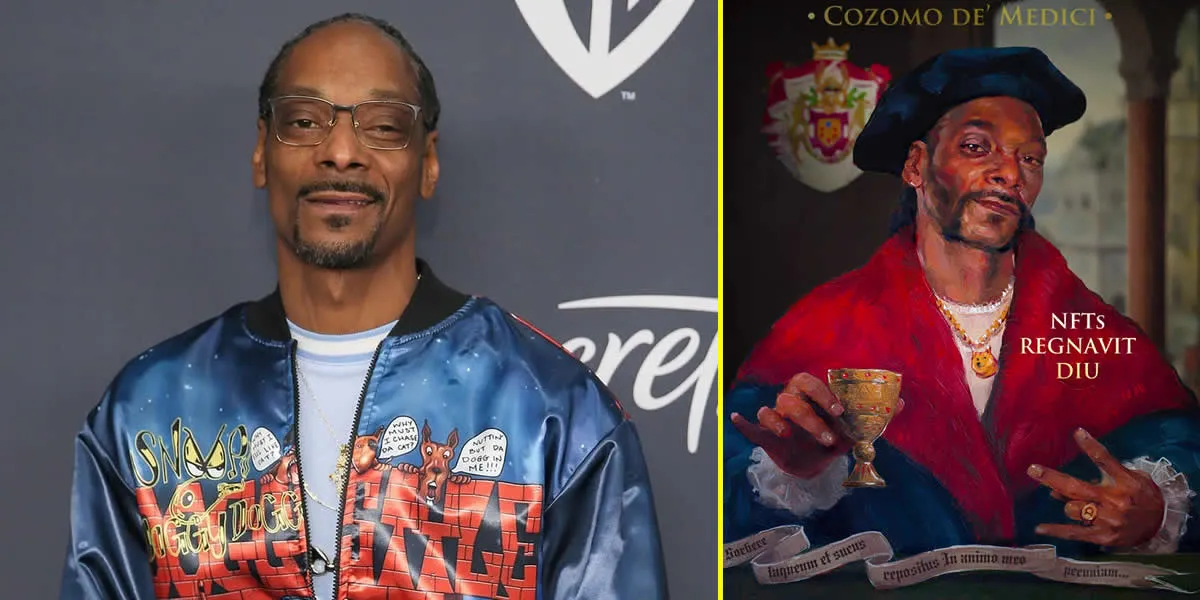

Snoop Dogg: West Coast Flair Meets Wallet Culture

From “Drop It Like It’s Hot” to household-name entrepreneur, the Long Beach icon Snoop Dogg has remixed culture for three decades. He moves effortlessly between music, media, and mainstream brand partnerships, and he’s turned that versatility into a playbook for digital ownership. If there’s a new lane that merges vibe with value—memes, metaverse moments, collectibles—he’ll cruise it first. That curiosity has made him an ambassador of sorts for bringing onboarding into everyday conversation, where wallets and keys aren’t intimidating; they’re just part of the lifestyle.

Receipts go back to 2013, when he publicly said his next record would be “available in bitcoin,” then engaged Coinbase and BitPay to make it real, years before most entertainers touched crypto. Fast-forward to the Web3 era: he outed himself as the prolific NFT collector Cozomo de’ Medici, rolled out headline NFT drops, and—after acquiring Death Row—declared it the first NFT-forward label, pushing catalog and new releases through metaverse-native platforms like Gala Music. The through-line isn’t meme-trading; it’s distribution and ownership: experimenting with digital scarcity, on-chain rights, and fan access while consistently acknowledging Bitcoin’s blue-chip role as the durable, highly liquid base asset in a broader creative portfolio.

50 Cent: Turning “In da Club” Hustle Into Hard-Money Headlines

The Queens native behind “In da Club” built a career on relentlessness—an instinct that translates neatly into spotting asymmetric upside. His pivots are legendary: from mixtapes to mainstream domination to savvy ventures. That same nose for opportunity shows up in his approach to new money primitives. He understands that the first movers don’t just ride waves—they create them. And in an era where audience communities can become economic engines, that matters.

The Bitcoin lore around Animal Ambition (2014) is instructive: he accepted crypto for album sales and, in 2018, headlines claimed the stash had ballooned to millions. The plot twist arrived in court filings the same year, where he said he hadn’t actually kept the coins—suggesting payment processors converted proceeds to dollars at the time—an early lesson in treasury policy, custody, and volatility that many artists would later study before experimenting themselves. Even with that walk-back, the episode mattered: it normalized the idea of borderless checkout for major releases and foreshadowed today’s direct-to-wallet commerce, while underscoring the difference between marketing talk and the operational discipline required to hold BTC through cycles.

Why These Moves Matter for Fans and the Industry

When very prominent artists start to take Bitcoin seriously, two things will occur. To begin with, the negative perception will mostly disappear. The discussions will no longer be about “Is this a real thing?” but rather about “How can I get into it safely?”—and that the shift will raise the need for education, security, and even regulation that consumers would be able to benefit from without killing innovation. Then, the creative economy would be given a foundation on which to build income streams that would be less affected by direct and indirect sales, easily accessible provenance, automated rewards, and global payouts that won’t be eaten up by fees. This is particularly useful for solo artists who are caught in the web of contracts and intermediaries.

In addition, by the mainstream artists’ adoption, Bitcoin has been redefined as a culture, not just mere code. It becomes the mainstay of a fan-first economy where ownership, access, and value are interchangeable across platforms. Imagine concert tickets that are totally secure against counterfeiting, limited-edition releases that are backed up by on-chain proof, or royalty divisions that are carried out digitally at once—no more following the statements, no more unclear dashboards. This is, of course, no longer the fantasy of tomorrow but rather the very natural transition toward the transparent, visible, and public ledger where scarcity cannot exist.

The Bottom Line

Ultimately, the combination of celebrities and sound money is changing the online value discussion. Colossal noises from the venues are enabling the millions to comprehend why a limited-supply digital asset can be important in a time of endless content and diminishing attention spans. They are showing that financial knowledge is not a barrier for creative people; it is the highway itself. And even though the light will continue to shift, the pillars they are constructing—learning, openness, and prudent adoption—will still be reaping rewards long after the last encore.